Area: Policy and financing

The discussion on housing regimes dates back to e neo-institutional turn in policy research which occurred during the 1980s. This literature viewed institutions not so much as “formal” entities but more as the culmination of conflicting power relations, market dynamics, and ideology. The study of these dynamics could, in turn, be used to understand the variegated development of post-war welfare states, as exemplified by Esping-Andersen’s seminal Three worlds of welfare capitalism (1990).

Kemeny defined the housing regime as “the social, political, and economic system of housing supply, distribution, and consumption, which determines the housing market opportunities of a certain period” (1981, p. 13). His framework follows the logic of the historical and institutional structure of society. Kemeny (2006) argues that, due to the central role of real estate in modern capitalism, housing systems follow similar paths, albeit with different logics. Studying the emergence of regimes of a different nature between countries, he distinguished between unitary and dualized housing regimes, based on their rental-market systems, that is: (a) countries with an open private sector but with a firmly regulated public sector are characterized by a dual rental market; and (b) societies where the private and public sectors are strictly regulated have a unitary rental market. In dualist countries (primarily the Anglo-Saxon ones), homeownership is commonplace, while in countries with an integrated/unitary system (such as Germany, Netherlands, and Scandinavian countries) renting is a realistic and even competitive alternative to ownership. Kemeny highlighted that the dominance of homeownership is not organically developed but is socially and politically constructed.

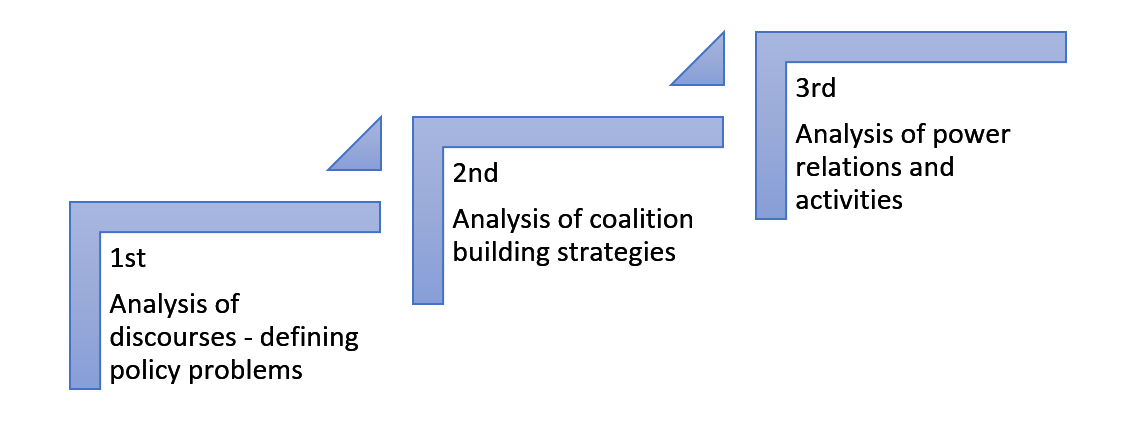

The above conceptualization of housing regime based on the functioning of rental market systems does not mirror the (Foucaultian) political and conflictual approach of Clapham, for whom a housing regime stands for a “set of discourses and social, economic and political practices that influence the provision, allocation, consumption [of housing] and housing outcomes in a given country” (2019, p. 24). He views policy as an arena where actors “negotiate and bargain” through discursive processes (Ruonavaara, 2020b). Clapham clearly distinguishes regime types from housing regimes. Regime types are useful for categorization since they can function as a baseline for comparative studies. However, “every housing regime is unique”(Ruonavaara, 2020b). Because of the complexity of the concept, Clapham (2019, p.17) proposes a three-stage analysis for housing policy (Figure 1).

Ruonavaara (2020b) finds Clapham’s approach nuanced but too general and broad, which – according to him - makes it less applicable. On the other hand, Hegedüs (2020) considers Clapham’s (2002) housing pathway reasonable, as it describes housing provision forms as a result of interactions. In line with Clapham, he argues that “interventions within the housing system can only be understood in the context of interactions between different housing market actors” (Hegedüs, 2020, p. 569). Consequently, an analysis that only focuses on the rental sector would lead to narrowed interpretations with low explanatory power.

More recently, Ruonavaara provided a new definition of housing regimes, which combines the elements of previous theories. He defined housing regime as a “set of fundamental principles according to which housing provision operates in some defined area (municipality, region, state) at a particular point in time” (2020a, p. 10). These principles are present in discourses, institutional arrangements, and political interventions. All actors have certain principles when operating in the system of housing provision at a given time and place. Housing regimes can be considered as the “principles of operation” (Ruonavaara, 2020a). In this sense, the housing regime concept faces challenges in its ability to represent an effective analytical tool for today’s housing systems. For Stephens (2020), it is necessary to rethink housing regime as a way to find middle-range theories given that current accounts of neoliberal convergence (Aalbers, 2016; Clapham, 2019) barely manage to explain the role of regime path-dependences in continuing to shape variegated housing outcomes.

References

Aalbers, M. (2016). The financialization of housing: A political economy approach. In Routledge studies in the modern world economy (1st ed.). Routledge.

Clapham, D. (2002). Housing Pathways: A Post Modern Analytical Framework. Housing, Theory and Society, 19(2), 57–68. https://doi.org/10.1080/140360902760385565

Clapham, D. (2019). Remaking housing policy: An international study. Routledge Taylor & Francis Group.

Esping-Andersen, G. (1990). The Three Worlds of Welfare Capitalism. Polity Press.

Hegedüs, J. (2020). “Limits of the Kemeny’s Housing Regime Theory” A Comment to Stephens’ Paper. Housing, Theory and Society, 37(5), 567–572. https://doi.org/10.1080/14036096.2020.1816569

Kemeny, J. (1981). The myth of home-ownership: private versus public choices in housing tenure. In Routledge Direct Editions. Routledge & Kegan Paul.

Kemeny, J. (2006). Corporatism and Housing Regimes. Housing, Theory and Society, 23(1), 1–18. https://doi.org/10.1080/14036090500375423

Ruonavaara, H. (2020a). Rethinking the concept of ‘housing regime.’ Critical Housing Analysis, 7(1), 5–14. https://doi.org/10.13060/23362839.2020.7.1.499

Ruonavaara, H. (2020b). Rethinking Jim Kemeny’s Theory of Housing Regimes. In Housing, Theory and Society (Vol. 37, Issue 5, pp. 519–520). Routledge. https://doi.org/10.1080/14036096.2020.1827626

Stephens, M. (2020). How Housing Systems are Changing and Why: A Critique of Kemeny’s Theory of Housing Regimes. Housing, Theory and Society, 37(5), 521–547. https://doi.org/10.1080/14036096.2020.1814404

Created on 24-02-2022 | Update on 23-10-2024

Related definitions

Housing Governance

Area: Policy and financing

Created on 16-02-2022 | Update on 23-10-2024

Read more ->Affordability

Area: Design, planning and building

Created on 03-06-2022 | Update on 23-10-2024

Read more ->Affordability

Area: Policy and financing

Created on 21-04-2023 | Update on 23-10-2024

Read more ->Window Guidance

Area: Policy and financing

Created on 24-04-2023 | Update on 23-10-2024

Read more ->Social Housing

Area: Policy and financing

Created on 17-06-2023 | Update on 23-10-2024

Read more ->Path Dependence

Area: Policy and financing

Created on 31-08-2023 | Update on 23-10-2024

Read more ->Framework

Area: Design, planning and building

Created on 19-06-2024 | Update on 23-10-2024

Read more ->Related cases

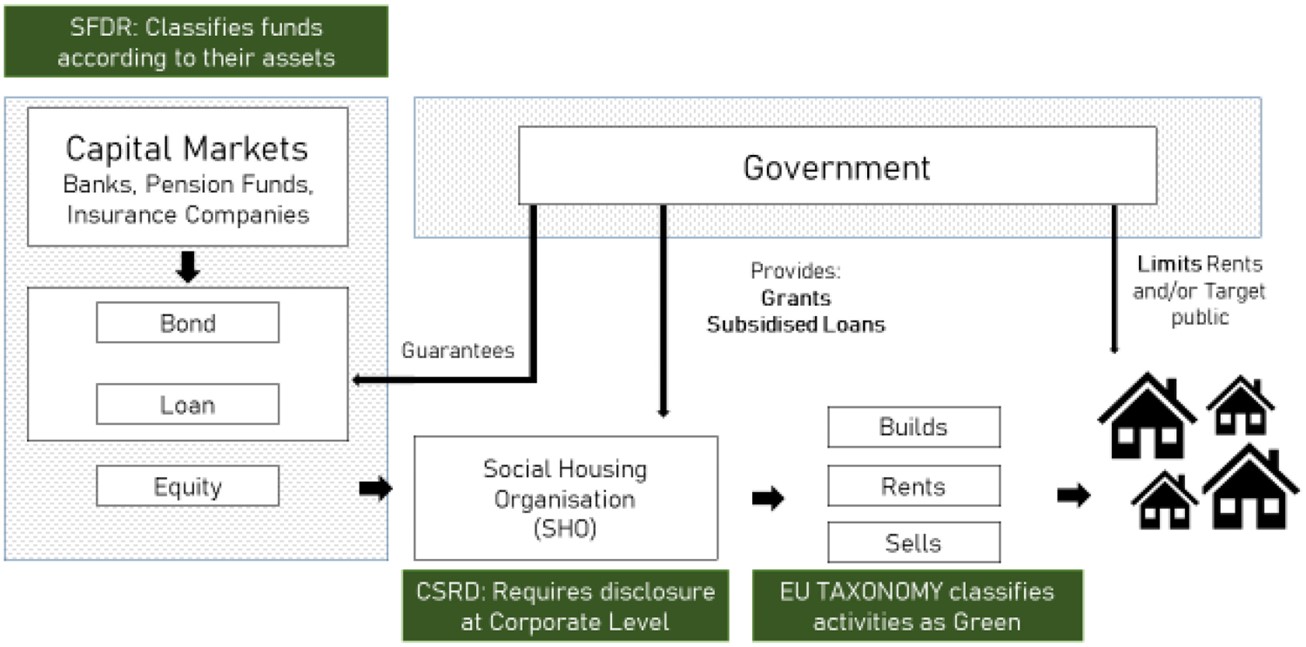

ESG finance and social housing decarbonisation

Created on 05-02-2024