Area: Design, planning and building

Financial wellbeing is an emerging concept with various definitions, many of which focus on the financial capabilities of individuals. A household's financial wellbeing encompasses its capacity to comfortably meet current and ongoing financial responsibilities, fostering a sense of security about future obligations while enjoying the ability to make life choices (Aubrey et al., 2022). Riitsalu et al. (2023) describe it as "feeling good about one's personal financial situation and being able to afford a desirable lifestyle both now and in the future" (p.2). Brüggen et al. (2017:229) frame it as "the perception of being able to sustain current and anticipated desired living standards and financial freedom." This perception highlights the robust link of financial wellbeing influencing human wellbeing, which is a combination of "feeling good and functioning well" (Ruggeri et al., 2020:1). Other terminologies are used interchangeably to describe financial wellbeing, including financial health, financial resilience, and financial freedom (Riitsalu et al., 2023).

In the UK, the public health sector cares to raise awareness of financial wellbeing due to its impact on households' health and populations' productivity. On their official website page on Financial Wellbeing, they used the definition by The Money and Pension Service (Gov.UK, 2022: online) as follows:

"Feeling secure and in control of your finances, both now and in the future. It's knowing that you can pay the bills today, can deal with the unexpected, and are on track for a healthy financial future."

These explanations and the terminology used, including "afford" and "sustain," underscore the interconnections between financial wellbeing and the vital components of household life. These components encompass mental health, productivity, and pursuing economic sustainability in the present and future. Therefore, a household's financial wellbeing is pressured by various housing-related factors, including the costs of renting or buying and non-housing costs like utility bills and repairs, all of which can affect the household's income.

The issue of rising housing costs directly undermines financial wellbeing. This trend can be attributed to several factors, including increased construction costs, labour shortages, and rising material prices (Brysch & Czischke, 2021). Furthermore, there is a notable shortage in affordable and social housing supply (Emekci, 2021; Gov.UK, 2022). This scarcity is partly due to decreased public investment in new dwellings (Housing Europe, 2021; OECD, 2020). This issue further burdens low-income households who face high private rental costs and a gradual reduction in housing benefits (Tinson & Clair, 2020).

This issue also leads many households to cut back on essential needs. For instance, interviews with social housing residents in Scotland with low to modest incomes revealed a tendency to prioritize rent payments over other necessities, such as food and heating (Garnham et al., 2022). Similarly, Adabre and Chan (2019), , citing Salvi del Pero et al. (2016), warned that:

"Households who are overburdened by housing cost may cut back on other important needs such as health care and diet. Besides, in the medium term, households may trade-off costs for lower quality housing such as smaller size of rooms and housing in poorer locations which lack better access to education and other social amenities. The latter has often been cited as the cause of residential segregation."

Another financial burden is non-housing costs involving energy costs for heating (AHC, 2019; Stone et al., 2011). According to Lee et al. (2022), this issue persists, contributing to financial strain and even excess winter deaths in the UK. Poor housing quality raises energy bills (AHC, 2019; Lameira et al., 2022). It presents the risk of considering dwellings as affordable due to local authority support focusing on housing costs alone (Granath Hansson & Lundgren, 2019), regardless of its quality impacting energy bills (OECD, 2020). Social housing residents, particularly the ageing population and those living in poverty are at increased risk of fuel poverty (Tu et al., 2022). Fuel poverty occurs when more than 10% of a household's income goes towards energy consumption for heating (Howden-Chapman et al., 2012).

Looking forward, two factors could continue burdening households’ financial wellbeing. One factor is the fluctuating energy prices that are often increasing, such as the case in the UK (Bolton, 2024). Another factor is the impact of climate change, leading to colder winters and the potential for overheating, increasing energy demand during extreme weather conditions, as warned by the Committee of Climate Change in the UK (Holmes et al., 2019).

Non-housing costs associated with extensive housing repairs can also impact household financial wellbeing, which may arise from several factors. For instance, selecting low-quality construction materials, workforce or equipment to reduce construction costs might lead to increased repair costs over time (Emekci, 2021). Hopkin et al. (2017) highlighted a related issue in England, where new housing defects were believed to be partly attributed to the building industry's prioritization of profitability over customer satisfaction. Another factor could be improper periodic maintenance, potentially accelerating the physical deterioration of the dwelling (Kwon et al., 2020). Additionally, dwellings may fall into disrepair due to unresponsive maintenance services from housing providers, and residents may lack the financial means to cover repair costs themselves (Garnham et al., 2022).

Financial wellbeing is closely tied to household income. Low-income households are particularly vulnerable to being burdened by rising housing costs (Housing Europe, 2021; OECD, 2020), leading to financial insecurity (Hick et al., 2022). In addition, they might suffer housing deprivation due to the increasing housing and non-housing expenses coupled with their declining incomes (Emekci, 2021; Wilson & Barton, 2018). The financial pressure due to low income is further exacerbated if a household member has a disability or severe illness, potentially consuming up to 35% of their income (AHC, 2019). Recently, the COVID-19 pandemic period highlighted households' financial wellbeing vulnerability to housing-related financial challenges (Brandily et al., 2020; Hick et al., 2022; National Housing Federation, 2020). During this period, job losses led to difficulties covering housing and non-housing costs, with a third of low-income social housing residents burdened by housing costs (OECD, 2020).

The issues discussed above on dwellings being of poor quality or unaffordable harm financial wellbeing, leading to residential segregation (Adabre & Chan, 2019; Salvi del Pero et al., 2016) as well as intensifying gaps of social injustice, health injustice, poverty, and fuel poverty (Barker, 2020; Garnham et al., 2022). Without addressing those housing-related issues, many households' financial wellbeing would remain vulnerable to economic insecurity even if they live in housing considered to be "affordable" in terms of rent-to-income ratio.

References

Adabre, M. A., & Chan, A. P. C. (2019). Critical success factors (CSFs) for sustainable affordable housing. Building and Environment, 156(February), 203–214. https://doi.org/10.1016/j.buildenv.2019.04.030

AHC. (2019). Defining and Measuring Housing Affordability-An Alternative Approach. In Affordable Housing Commission. www.affordablehousingcommission.org

Aubrey, M., Morin, A. J. S., Fernet, C., & Carbonneau, N. (2022). Financial well-being: Capturing an elusive construct with an optimized measure. Frontiers in Psychology, 13(August). https://doi.org/10.3389/fpsyg.2022.935284

Bolton, P. (2024). Domestic energy prices Summary. House of Commons Library, January.

Brandily, P., Brebion, C., Briole, S., & Khoury, L. (2020). A Poorly Understood Disease? The Unequal Distribution of Excess Mortality Due to COVID-19 Across French Municipalities. SSRN Electronic Journal, 1–35. https://doi.org/10.2139/ssrn.3682513

Brüggen, E. C., Hogreve, J., Holmlund, M., Kabadayi, S., & Löfgren, M. (2017). Financial well-being: A conceptualization and research agenda. Journal of Business Research, 79, 228–237. https://doi.org/10.1016/j.jbusres.2017.03.013

Brysch, S. L., & Czischke, D. (2021). Affordability through design: the role of building costs in collaborative housing. Housing Studies, 0(0), 1–21. https://doi.org/10.1080/02673037.2021.2009778

Emekci, S. (2021). How the pandemic has affected Turkish housing affordability: why the housing running cost is so important. City, Territory and Architecture, 8(1). https://doi.org/10.1186/s40410-021-00132-3

Garnham, L., Rolfe, S., Anderson, I., Seaman, P., Godwin, J., & Donaldson, C. (2022). Intervening in the cycle of poverty, poor housing and poor health: the role of housing providers in enhancing tenants' mental wellbeing. Journal of Housing and the Built Environment, 37(1), 1–21. https://doi.org/10.1007/s10901-021-09852-x

Gov.UK. (2022). Financial wellbeing: applying All Our Health. https://www.gov.uk/government/publications/financial-wellbeing-applying-all-our-health/financial-wellbeing-applying-all-our-health

Granath Hansson, A., & Lundgren, B. (2019). Defining Social Housing: A Discussion on the Suitable Criteria. Housing, Theory and Society, 36(2), 149–166. https://doi.org/10.1080/14036096.2018.1459826

Hick, R., Pomati, M., & Stephens, M. (2022). Housing and poverty in Europe : Examining the house prices. April.

Holmes, G., Hay, R., Davies, E., Hill, J., Barrett, J., Style, D., Vause, E., Brown, K., Gault, A., & Stark, C. (2019). UK housing: Fit for the future? In Committee on Climate Change (Issue February).

Hopkin, T., Lu, S. L., Rogers, P., & Sexton, M. (2017). Key stakeholders' perspectives towards UK new-build housing defects. International Journal of Building Pathology and Adaptation, 35(2), 110–123. https://doi.org/10.1108/IJBPA-06-2016-0012

Housing Europe. (2021). The state of housing in Europe. Housing Europe, 25–68. https://doi.org/10.1787/9789264298880-4-en

Howden-Chapman, P., Viggers, H., Chapman, R., O'Sullivan, K., Telfar Barnard, L., & Lloyd, B. (2012). Tackling cold housing and fuel poverty in New Zealand: A review of policies, research, and health impacts. Energy Policy, 49, 134–142. https://doi.org/10.1016/j.enpol.2011.09.044

Kwon, N., Song, K., Ahn, Y., Park, M., & Jang, Y. (2020). Maintenance cost prediction for aging residential buildings based on case-based reasoning and genetic algorithm. Journal of Building Engineering, 28(October 2019), 101006. https://doi.org/10.1016/j.jobe.2019.101006

Lameira, G., Rocha, L., Jorge, R., & Ramos, G. (2022). Affordable Futures Past : Rethinking Contemporary Housing Production in Portugal While Revisiting Former Logics. 7(1), 223–240.

Lee, A., Sinha, I., Boyce, T., Allen, J., & Goldblatt, P. (2022). Fuel Poverty , and Health Inequalities in the Uk Contents.

National Housing Federation. (2020). Housing issues during lockdown: health, space and overcrowding. 302132, 1–12. https://www.housing.org.uk/globalassets/files/homes-at-the-heart/housing-issues-during-lockdown---health-space-and-overcrowding.pdf

OECD. (2020). Social housing: A key part of past and future housing policy. Employment, Labour, and Social Affairs Policy Briefs, OECD, 1–32.

Riitsalu, L., Sulg, R., Lindal, H., Remmik, M., & Vain, K. (2023). From Security to Freedom— The Meaning of Financial Well-being Changes with Age. Journal of Family and Economic Issues. https://doi.org/10.1007/s10834-023-09886-z

Ruggeri K, Garcia-Garzon E, Maguire Á, Matz S, & Huppert F. (2020). Well-being is more than happiness and life satisfaction: A multidimensional analysis of 21 countries. Health and Quality of Life OutcomesHealth and Quality of Life Outcomes [revista en Internet] 2020 [acceso 4 de julio de 2021]; 18(1): 1-16. Health and Quality of Life Outcomes, 1–16. https://hqlo.biomedcentral.com/track/pdf/10.1186/s12955-020-01423-y.pdf

Salvi del Pero, A., Adema, W., Ferraro, V., & Frey, V. (2016). Policies to promote access to good quality affordable housing in OECD countries. OECD Social, Employment and Migration Working Papers., 176.

Stone, M., Burke, T., & Ralston, L. (2011). The residual income approach to housing affordability : the theory and the practice. In Australian Housing and Urban Research Institute (Issue 139).

Tinson, A., & Clair, A. (2020). Better housing is crucial for our health and the COVID-19 recovery. The Health Foundation, December, 1-25. Accessed 18 April 2021. https://www.health.org.uk/sites/default/files/2021-01/2020 - Better housing is crucial.pdf

Tu, G., Morrissey, K., Sharpe, R. A., & Taylor, T. (2022). Combining self-reported and sensor data to explore the relationship between fuel poverty and health well-being in UK social housing. Wellbeing, Space and Society, 3, 100070. https://doi.org/10.1016/j.wss.2021.100070

Wilson, W., & Barton, C. (2018). What is 'affordable housing'? | Shelter. House of Commons Library, 07747(07747), 1–35. https://blog.shelter.org.uk/2015/08/what-is-affordable-housing/

Created on 14-10-2024 | Update on 13-06-2025

Related definitions

Affordability

Area: Policy and financing

Created on 27-08-2021 | Update on 20-04-2023

Read more ->Community Empowerment

Area: Community participation

Created on 03-06-2022 | Update on 23-10-2024

Read more ->Just Transition

Area: Policy and financing

Created on 03-06-2022 | Update on 23-10-2024

Read more ->Affordability

Area: Design, planning and building

Created on 03-06-2022 | Update on 23-10-2024

Read more ->Social Sustainability

Area: Community participation

Created on 03-06-2022 | Update on 23-10-2024

Read more ->Urban Commons

Area: Community participation

Created on 14-10-2022 | Update on 23-10-2024

Read more ->Life Cycle Costing

Area: Design, planning and building

Created on 05-12-2022 | Update on 23-10-2024

Read more ->Affordability

Area: Policy and financing

Created on 21-04-2023 | Update on 23-10-2024

Read more ->Housing Affordability

Area: Design, planning and building

Created on 17-10-2023 | Update on 23-10-2024

Read more ->Energy Poverty

Area: Policy and financing

Created on 17-10-2023 | Update on 23-10-2024

Read more ->Social Value

Area: Community participation

Created on 16-11-2023 | Update on 23-10-2024

Read more ->Financialisation

Area: Policy and financing

Created on 18-03-2024 | Update on 27-06-2025

Read more ->Related cases

La Borda

Created on 16-10-2024

Pre-1919 Niddrie Road Retrofit – An Example of Care for Climate and Health

Created on 15-11-2024

A Combined Energy Efficiency and Levelling Up Scheme: the Dutch ‘Volkshuisvestingsfonds’

Created on 25-09-2024

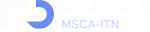

York's Duncombe Square Housing: Towards Affordability, Sustainability, and Healthier Living

Created on 15-11-2024

Can70 senior cooperative housing: Aging in community

Created on 22-04-2025

Housing retrofit subsidies in the Netherlands

Created on 20-11-2024

M.Elsinga. Supervisor, M.Haffner. Supervisor, A.Fernandez. ESR12

Related publications

Croon, T.M., Hoekstra, J.S.C.M., Elsinga, M.G., Dalla Longa, F., & Mulder, P. (2022, June). Mind the gap: the use of poverty gap indices to quantify energy poverty in the netherlands [Conference Poster]. In 3rd International Conference on Energy Research & Social Science, Manchester, UK.

Posted on 22-02-2026

Conference

Read more ->Fernández, A., Haffner, M., & Elsinga, M. (2022, June). Analysing the financial impact of housing retrofit policies on Dutch homeowners: Comparing user cost and cash flow approaches [Poster presentation]. In 3rd International Conference on Energy Research & Social Science, Manchester, UK.

Posted on 22-06-2022

Conference

Read more ->